Methods Of Money Laundering Examples

The concept of cash laundering is very important to be understood for these working in the financial sector. It's a process by which soiled cash is transformed into clean cash. The sources of the money in precise are prison and the cash is invested in a manner that makes it appear to be clean cash and conceal the identification of the criminal a part of the money earned.

Whereas executing the financial transactions and establishing relationship with the new customers or sustaining present customers the obligation of adopting ample measures lie on every one who is part of the group. The identification of such ingredient in the beginning is straightforward to cope with instead realizing and encountering such conditions in a while within the transaction stage. The central financial institution in any nation offers full guides to AML and CFT to fight such activities. These polices when adopted and exercised by banks religiously present enough security to the banks to discourage such conditions.

The major purpose is to change the form of the proceeds from conspicuous bulk cash to some equally valuable but less conspicuous form. Money made from an illegal activity is known as dirty money In order to deposit the money into the bank it must appear as legal profit or earnings a process referred to as laundering In this blog we explore a number of ways in which money laundering can occur and how you could face false accusations of the crime.

This is how the circuit works.

Methods of money laundering examples. Some of the most common techniques used in money laundering are- Deposit structuringsmurfing. This lesson explores the three stages of money laundering and gives. For an example of money laundering methods there are operations without economic or other sense when money from one account passes on some and from all of them back to another account.

Money Laundering Example One of the most commonly used and simpler methods of washing money is by funneling it through a restaurant or other business where there are a lot of cash transactions. In 2016 23 billion dollars were laundered from Russia through commercial banks of Moldova. 5 Most Frequently Used Methods of Money Laundering 1.

Money laundering is the process of concealing or destroying the paper trail associated with money obtained through illicit means. Four methods of money launderingcash smuggling casinos and other gambling venues insurance. Often known as smurfing is a method of placement by which cash is broken into smaller deposits of money used to defeat suspicion of money laundering and to avoid anti-money laundering reporting requirements.

Leveraging loose banking norms. A governmental official in Brazil responsible for construction permits for real estate projects handed over his illicit corruption money in cash to his lawyer in Sao Paulo. Historically methods of money laundering have included smurfing or the structuring of the banking of large amounts of money into multiple small transactions often spread out.

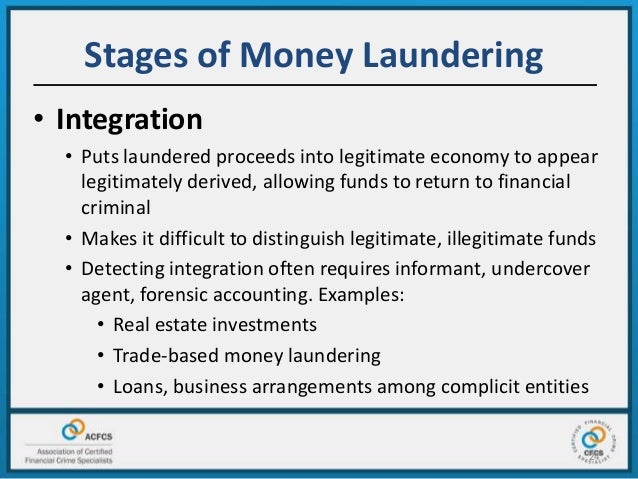

Further main chain represented roughly and more specifically its branches which it. This is the first step showing one example of some frequently used money laundering methods. Layering The purpose of.

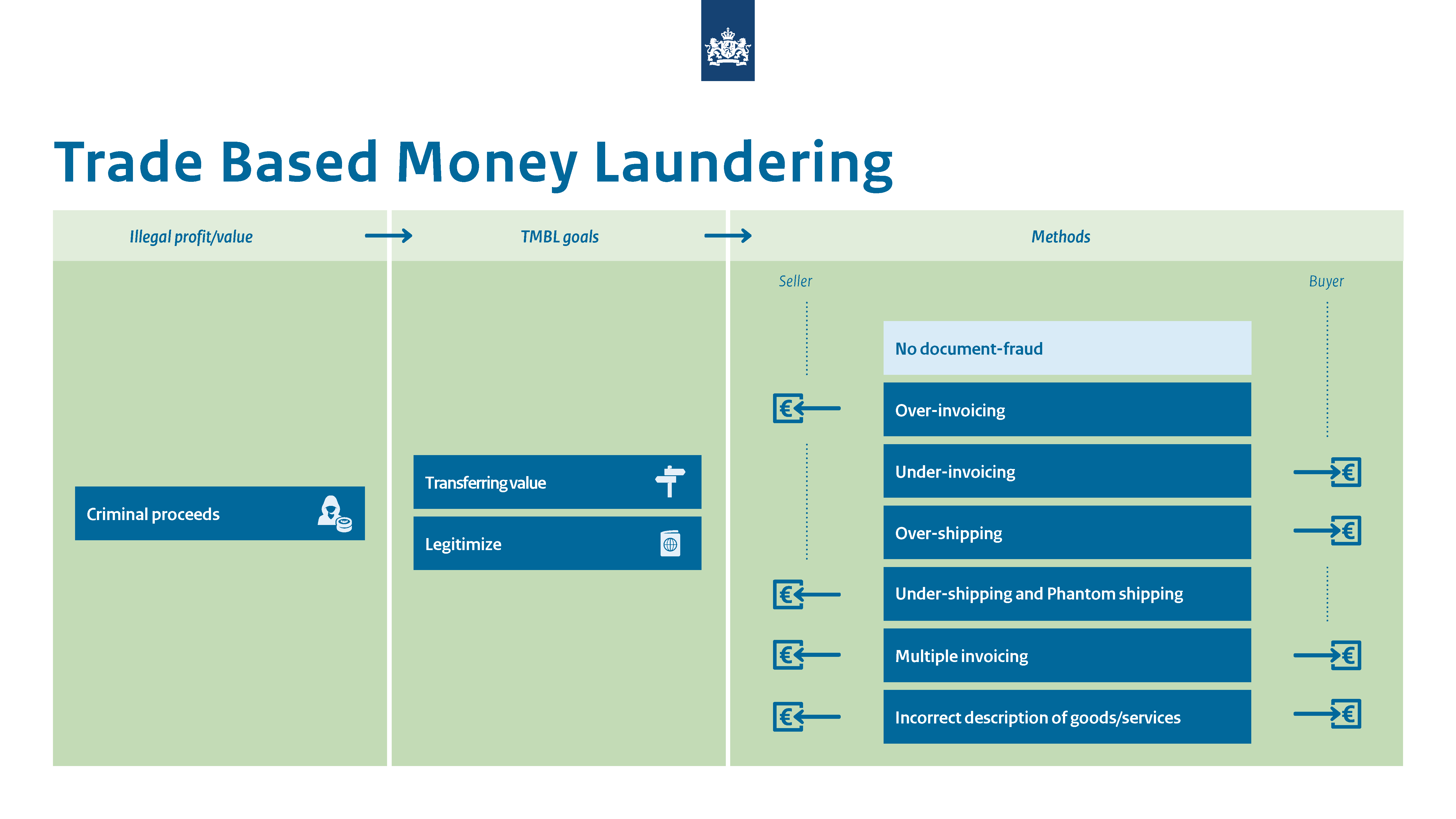

Let me give you a real life example of stages of money laundering. What Are The Methods Used for Money Laundering. These include bank methods smurfing currency exchanges and double-invoicing.

However smaller scale criminals or first time offenders often use simpler methods in their attempt avoid detection. A classic example of laundering funds involves the physical smuggling of banknotes and depositing them in a different financial institution such as a shell bank in an offshore nation. Some of these are described below with examples.

Large scale criminal groups may use complex money laundering techniques in order to avoid detection. Transferring money from bank to bank or from account to account. Purchase of assets with cash is a classic money laundering method.

Such money laundering techniques may include. Various institutions and methods are used for washing money. There are many techniques through which money laundering can take place.

There are different methods of money laundering through financial system. Are associated with only one of the three phases of money laundering while others are usable in any of the phases of placement layering and integration. The criminal could also go into a casino exchange the funds for chips gamble for.

The classical methods of money laundering include the structuring of large amounts of money into multiple small transactions at banks often called as smurfing and the use of foreign exchanges cash smugglers and wire transfers to move money across borders. For example a criminal could use a large number of complex wire transfers to disguise the illegal origin of the funds. Example of the method of money laundering is the Moldavian scheme.

Anti Money Laundering Overview Process And History

What Are The Three Stages Of Money Laundering

Tanzania Financial Intelligence Unit Money Laundering Definition Kitengo Cha Kudhibiti Fedha Haramu Maana Ya Biashara Ya Fedha Haramu

Understanding The Risks Of Money Laundering In Sri Lanka Daily Ft

Commonalities Money Laundering Ethics International Standards Gac

Understanding The Risks Of Money Laundering In Sri Lanka The Lakshman Kadirgamar Institute

What Is Trade Based Money Laundering Tbml Amlc Eu

How Money Laundering Works Howstuffworks

Money Laundering Terrorist Financing Are You Aware Anti Money Laundering Compliance Unit

Financial Action Task Force On Money Laundering Fatf Fincen Gov

Cryptocurrency Money Laundering Explained Bitquery

International Banking Wealth Management Aml Quality Control Effective Anti Money Laundering Prezentaciya Onlajn

Money Laundering Define Motive Methods Danger Magnitude Control

What Is Money Laundering And How Is It Done

The world of regulations can look like a bowl of alphabet soup at occasions. US money laundering laws are not any exception. We now have compiled a list of the top ten cash laundering acronyms and their definitions. TMP Threat is consulting firm centered on defending monetary providers by lowering risk, fraud and losses. We now have big financial institution experience in operational and regulatory threat. We have a powerful background in program management, regulatory and operational threat as well as Lean Six Sigma and Business Process Outsourcing.

Thus money laundering brings many antagonistic consequences to the organization due to the risks it presents. It increases the likelihood of main risks and the opportunity value of the financial institution and in the end causes the bank to face losses.

Comments

Post a Comment